Page 30 - _ 180314 Special Yucaipa GSA Packet

P. 30

Grant Agreement No. 46000XXXX

Page 28 of 38

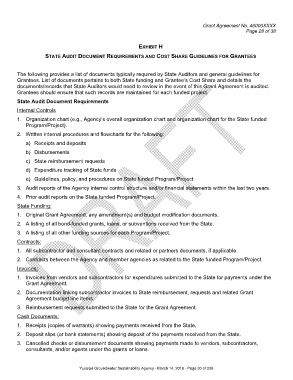

EXHIBIT H

STATE AUDIT DOCUMENT REQUIREMENTS AND COST SHARE GUIDELINES FOR GRANTEES

The following provides a list of documents typically required by State Auditors and general guidelines for

Grantees. List of documents pertains to both State funding and Grantee’s Cost Share and details the

documents/records that State Auditors would need to review in the event of this Grant Agreement is audited.

Grantees should ensure that such records are maintained for each funded project.

State Audit Document Requirements

Internal Controls

1. Organization chart (e.g., Agency’s overall organization chart and organization chart for the State funded

Program/Project).

2. Written internal procedures and flowcharts for the following:

a) Receipts and deposits

b) Disbursements

c) State reimbursement requests

d) Expenditure tracking of State funds

e) Guidelines, policy, and procedures on State funded Program/Project

3. Audit reports of the Agency internal control structure and/or financial statements within the last two years.

4. Prior audit reports on the State funded Program/Project.

State Funding:

1. Original Grant Agreement, any amendment(s) and budget modification documents.

2. A listing of all bond-funded grants, loans, or subventions received from the State.

3. A listing of all other funding sources for each Program/Project.

Contracts:

1. All subcontractor and consultant contracts and related or partners documents, if applicable.

2. Contracts between the Agency and member agencies as related to the State funded Program/Project.

Invoices:

1. Invoices from vendors and subcontractors for expenditures submitted to the State for payments under the

Grant Agreement.

2. Documentation linking subcontractor invoices to State reimbursement, requests and related Grant

Agreement budget line items.

3. Reimbursement requests submitted to the State for the Grant Agreement.

Cash Documents:

1. Receipts (copies of warrants) showing payments received from the State.

2. Deposit slips (or bank statements) showing deposit of the payments received from the State.

3. Cancelled checks or disbursement documents showing payments made to vendors, subcontractors,

consultants, and/or agents under the grants or loans.

Yucaipa Groundwater Sustainability Agency - March 14, 2018 - Page 30 of 226